Credit Accounts, Customer Statements and Accounts Receivable

MicroBiz Cloud let’s you to set-up and manage customer credit accounts, allowing your customers to bill their purchases to their own credit account.

Ways our customer credit account features can improve your business

Extend credit to customers

Allow customers to bill purchases to the credit accounts

Track credit account activity

View aggregated credit account activity by authorized user and by transaction

Send monthly statements

Generate accounts receivable statements, post payments, and adjust balances

Offer customer-based pricing

Set up special pricing by customer group based on credit account

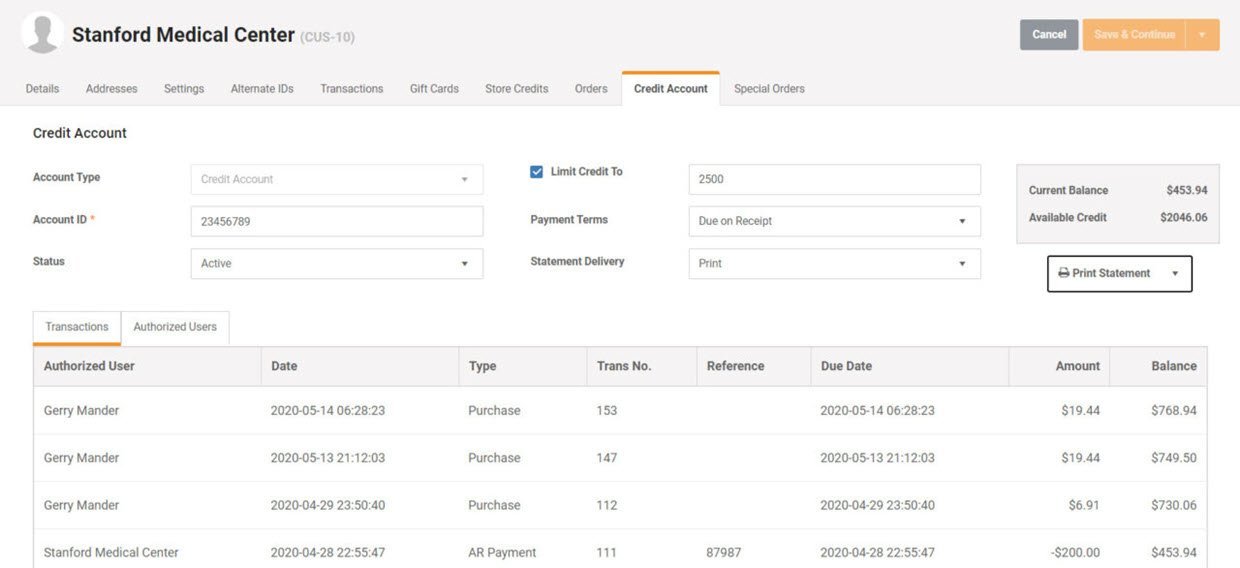

Credit Accounts and AR Statement Management

Offer and manage customer credit accounts, including defining authorized users, setting credit limits and payment terms and tracking the current account balance and available credit. Credit account records display all charges to the accounts, payments on outstanding balances and authorized user activity.

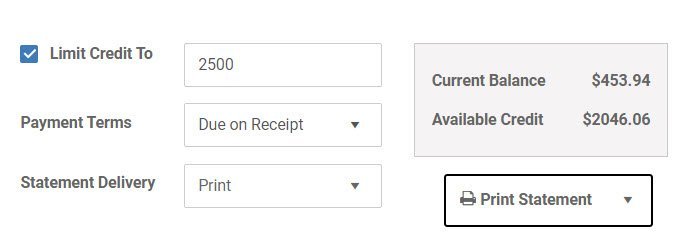

Account Credit Limits

Set credit limits for each credit account. The system will prevent transactions that cause the amount due to exceed this credit limit.

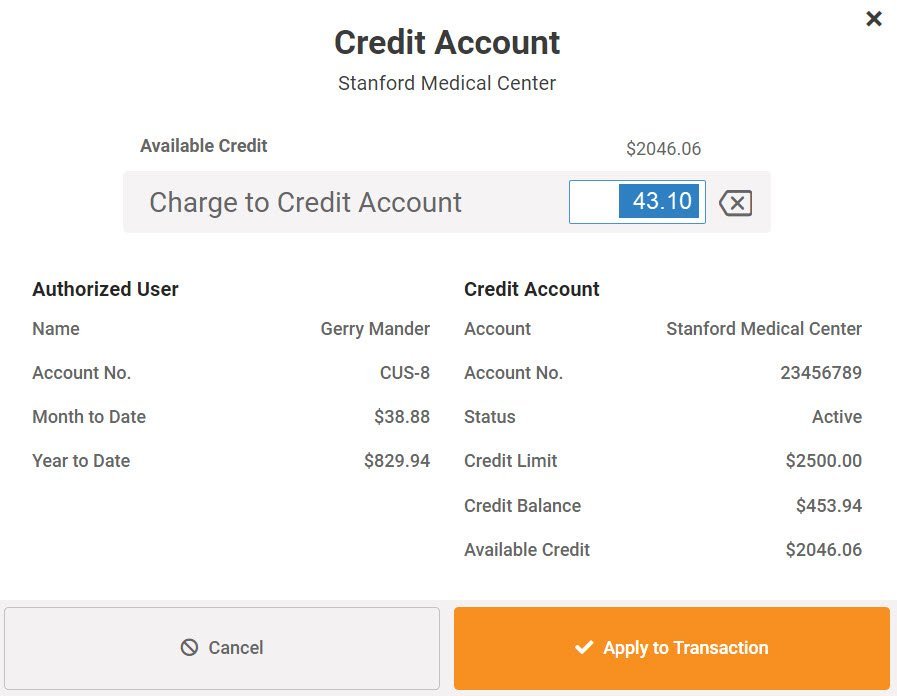

Charge to Credit Account from Front Register with One Click

Charge transactions to a credit account of an authorized user from the front register. Credit account front register screens display the current balances and remaining credit on the account being charged. Payments on account can be made from the front register using any available payment method.

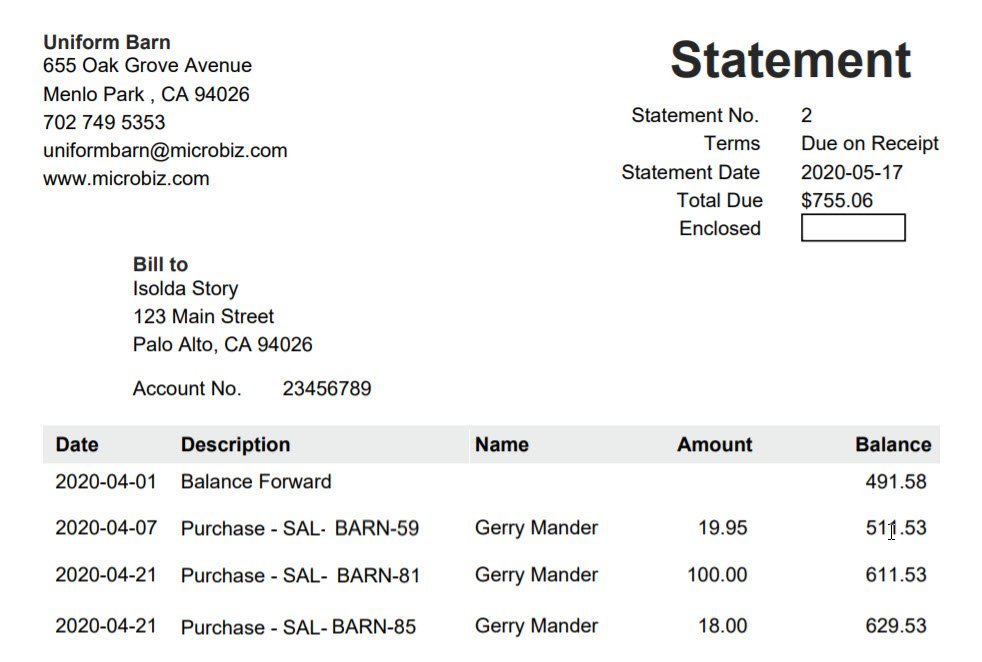

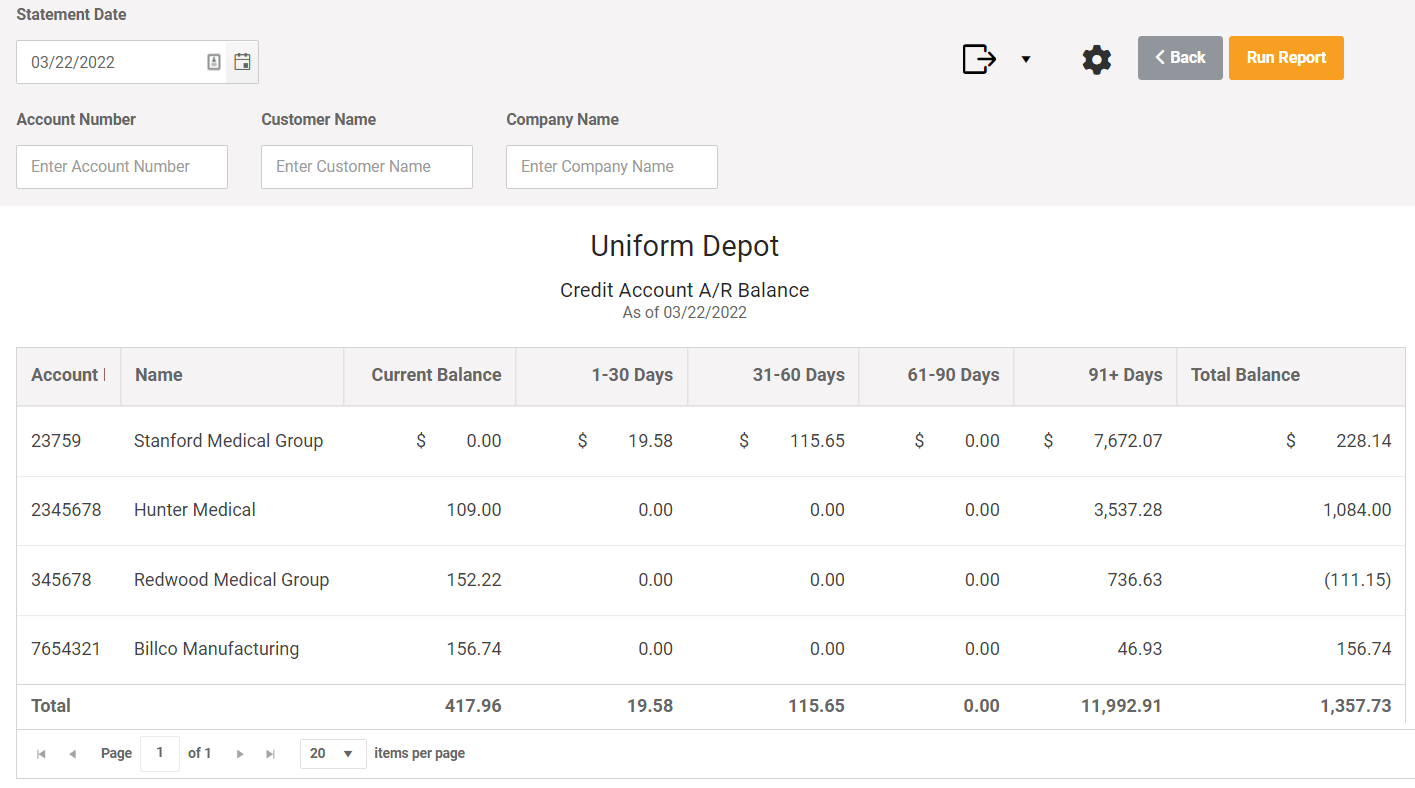

A/R Statements

Quickly generate full page accounts receivable statements which can be printed or emailed to customers. Statements show charges and payments on the outstanding balance. You can chose to display the individual items charged to the account or just the transaction total on the statements. The system also calculates A/R aging buckets based on the statement dates.

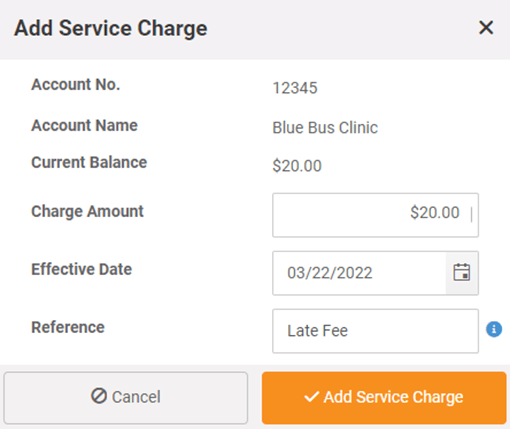

Add Service Charges and Issue Credits

Add service charges to a statement for late fees and other charges. Or, issue credits for returns and reversal of fees. Late fees can be calculated based on a percentage of the outstanding balance.

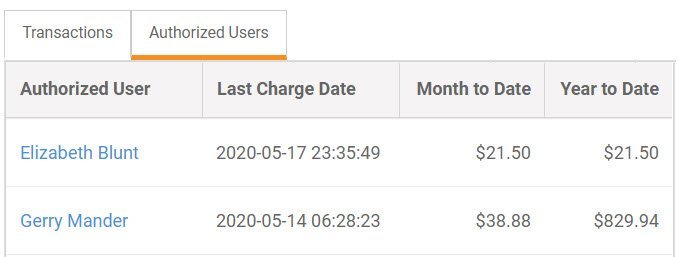

Assign Authorized Users to Credit Accounts

Assign employees to a credit account as authorized users. View each transaction made to a credit account by authorized users or view the monthly activity by each authorized user.

Credit Account Reports

The Transactions on Account report shows all transactions involving a credit account, including charges to credit accounts and payments on accounts. The Transactions Payments Audit report can be filtered to display credit account transactions and payments over any date period.

Take a tour of the key features in MicroBiz Cloud

FAQs

Q. Does MicroBiz use open item or balance forward account receivable methodology?

A. MicroBiz Cloud uses the balance forward methodology.

Q. Are customer accounts only available in Cloud?

A. Customer credit accounts are available in both MicroBiz Cloud and MicroBiz for Windows.

Q. Does MicroBiz Cloud restrict transactions above the credit limit?

A. The credit limit is visible on the tender screen when charging to an account and the system limits the amount that can be charges to the remaining available amount of the credit limit. So the system prevents the credit limit to be exceeded.

Q. Can you set up late payments fees as a percentage of outstanding balance?

A. You can add dollar amount service charges and issue credits to a customer credit account, but MicroBiz does not automatically calculate late fees a percentage of the outstanding balance.

Want to learn more?

Sign up for a free trial store. No credit card required.

Submit a question or request using a web form.

Schedule a one-on-one online demo with a sales rep.

Or call our sales department at 702 749-5353 option 2